Mastering 1031 Exchanges: Strategic

- Description

- Curriculum

- FAQ

- Grade

Unlock Tax-Saving Opportunities with 1031 Exchange

Introduction to 1031 Exchange

Gain insight into the basics of a 1031 exchange and discover how it can help you legally minimize your tax liability. This course will equip you with the knowledge to utilize this powerful tax-deferral strategy effectively.

Strategic Financial Planning

Understand the essential rules of 1031 exchanges to make informed decisions on when and how to leverage this opportunity to your advantage. Learn how smart financial planning can help preserve and grow your wealth.

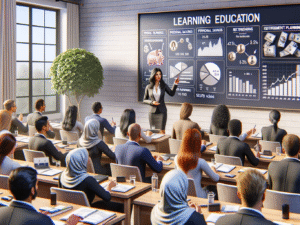

Identifying and Maximizing Eligible Replacement Properties

Explore strategies to successfully identify eligible replacement properties. Master the 45-day identification period and the 180-day exchange period to ensure you make the most of your opportunities.

Comprehensive Guidance on Exchange Types

Delve into the various types of 1031 exchanges, with a focus on mastering deferred exchanges. Gain a comprehensive understanding to apply these strategies effectively in your financial planning.

Understanding Tax Implications

Learn about the tax implications of a 1031 exchange, distinguishing between fully nontaxable and partially taxable exchanges. Manage “boots” strategically for maximum financial benefit and optimize your tax strategy.

Working with Qualified Intermediaries

Discover how to collaborate effectively with qualified intermediaries to save time and money. Ensure compliance with IRS regulations while maximizing the efficiency of your 1031 exchanges.

Taking Charge of Your Financial Future

Learn to calculate gain realized, gain recognized, and how to compute basis and depreciation recapture. Understand the intricacies of managing mortgage considerations and correctly filing Form 8824.

Conclusion

Empower yourself with the knowledge and tools necessary to take control of your financial future. By mastering 1031 exchanges, you can strategically preserve your wealth and achieve significant tax savings.

-

1Understanding the Basics of 1031 ExchangesText lessonIn this engaging beginner's guide to 1031 Exchanges, students will learn the essential concepts and benefits of using 1031 exchanges in real estate investments. The lesson will cover key terminologies, the step-by-step process, and critical rules to ensure successful tax-deferred exchanges, empowering participants with the foundational knowledge to make informed investment decisions.

-

2The Importance of Tax SavingsText lessonIn this lesson, "Maximizing Your Wealth: The Essential Guide to Tax Savings," students will discover key strategies for minimizing tax liabilities and enhancing financial growth. Through practical examples and expert tips, learners will gain a comprehensive understanding of how to identify tax-saving opportunities and implement effective financial planning techniques.

-

3Legal Framework and ComplianceText lessonIn the "Understanding Legal Frameworks and Compliance Essentials" lesson, students will delve into the core components of legal systems and the critical importance of compliance in various industries. This engaging session will equip learners with the knowledge to navigate complex legal landscapes, recognize key compliance requirements, and implement effective strategies to uphold ethical standards and regulatory obligations.

-

4Quiz: Basics of 1031 Exchanges21 questions

-

5When to Use 1031 ExchangesText lessonIn this lesson, students will explore the strategic benefits of 1031 exchanges in real estate investments, learning when and how to effectively defer capital gains taxes to enhance portfolio growth. Through practical examples and clear guidelines, participants will gain the skills necessary to identify suitable opportunities for utilizing 1031 exchanges, ensuring informed decision-making in their investment strategies.

-

6Leveraging Tax-Deferral StrategiesText lessonIn "Maximizing Wealth: Mastering Tax-Deferral Strategies," students will uncover the essential techniques for leveraging tax-deferral options to enhance their financial growth. This lesson will guide learners through the intricacies of deferring taxes, empowering them to optimize their investments and strategic financial planning for long-term wealth maximization.

-

7Informed Decision-MakingText lessonIn "Mastering Informed Decision-Making: A Comprehensive Guide," students will delve into the principles and strategies essential for making sound, evidence-based decisions. This lesson equips learners with the tools to critically analyze information, weigh options effectively, and apply systematic approaches to achieve optimal outcomes in various real-world scenarios.

-

8Quiz: Financial Planning Strategies21 questions

-

9Eligible Replacement PropertiesText lessonIn this lesson, students will explore the intricacies of identifying eligible replacement properties within the framework of 1031 exchanges. They will gain an understanding of the rules and criteria that govern property eligibility, enabling them to navigate and maximize the benefits of tax-deferred real estate transactions effectively. Through practical examples and expert insights, learners will develop the skills needed to strategically select properties that align with their investment goals while complying with IRS regulations.

-

10Maximizing the 45-Day Identification PeriodText lessonIn "Mastering the 45-Day Identification Period: Strategies for Success," students will delve into effective techniques for optimizing the crucial 45-day timeframe in real estate transactions. This lesson will equip you with strategies to identify and select the best investment properties, ensuring compliance and maximizing your returns. Join us to enhance your decision-making skills and confidently navigate this pivotal period.

-

11Utilizing the 180-Day Exchange PeriodText lessonIn this lesson, students will gain a comprehensive understanding of the 180-Day Exchange Period, delving into its significance and strategic applications. Through a step-by-step guide, learners will master key techniques to effectively navigate and optimize this time frame, ensuring successful exchanges and maximizing potential benefits.

-

12Assignment: Property Identification ExerciseText lessonIn "Identifying Property: Your Guide to Mastering Real Estate Evaluation," students will engage in a hands-on Property Identification Exercise designed to sharpen their skills in assessing real estate assets. Through practical assignments, participants will learn to evaluate various property types, understand key market indicators, and apply critical thinking to make informed investment decisions. This lesson ensures that learners gain the essential tools and confidence needed for successful real estate analysis.

-

13Exploring Various Exchange TypesText lessonIn this comprehensive guide, students will explore the diverse landscape of exchanges, from stock exchanges to cryptocurrency platforms, understanding their unique functions and significance in the global economy. Through engaging discussions and practical examples, learners will gain insights into how these exchanges operate, the key players involved, and their impact on market dynamics.

-

14Deferred Exchanges ExplainedText lessonDive into the world of deferred exchanges with our comprehensive guide, designed to demystify the intricacies of this tax-deferral strategy. In this lesson, you'll explore the fundamental principles, identify key benefits, and uncover the step-by-step process of executing a successful deferred exchange, empowering you with the knowledge to leverage this powerful tool effectively.

-

15Complex Exchange ScenariosText lessonIn this lesson on "Navigating Complex Exchange Scenarios: Strategies and Solutions," students will explore advanced techniques for managing intricate exchange processes. By examining real-world examples and engaging in interactive problem-solving, learners will acquire strategic skills to effectively address and resolve multifaceted challenges in exchange systems.

-

16Quiz: Types of 1031 Exchanges21 questions

-

17Understanding Taxable and Nontaxable ExchangesText lessonIn this lesson, students will explore the fundamental differences between taxable and nontaxable exchanges, gaining a clear understanding of how each impacts financial decisions and tax obligations. Through engaging examples and interactive discussions, participants will learn to identify key characteristics of each exchange type and apply this knowledge to real-world scenarios, enhancing their financial literacy and tax planning skills.

-

18Handling 'Boots' for Financial BenefitText lessonIn this lesson, students will explore strategic approaches to managing 'Boots'—a crucial financial asset—to maximize their financial gains. Participants will learn key tactics for assessing risk, optimizing investment opportunities, and leveraging 'Boots' for long-term financial success. Join us to transform your understanding of 'Boots' into actionable financial strategies.

-

19Strategic Tax ManagementText lessonIn the lesson "Mastering Strategic Tax Management: Optimize Your Financial Planning," students will gain essential skills to strategically manage taxes, enabling them to maximize savings and enhance financial planning. Participants will explore effective tax strategies, learn to identify potential deductions, and understand how to align financial goals with tax regulations for optimized outcomes.

-

20Quiz: Tax Implications of 1031 Exchanges21 questions

-

21Role of Qualified IntermediariesText lessonIn this lesson, students will delve into the pivotal role of Qualified Intermediaries in 1031 Exchanges, exploring how they facilitate tax-deferred property transactions. By the end of the session, learners will understand the regulatory requirements, best practices, and responsibilities of these intermediaries, equipping them with the knowledge to effectively navigate and utilize 1031 Exchanges in real estate investments.

-

22Ensuring IRS ComplianceText lessonIn "Mastering IRS Compliance: Essential Guidelines for Businesses," students will learn the critical steps to ensure their business adheres to IRS regulations, minimizing the risk of audits and penalties. This lesson provides practical insights into tax filing requirements, record-keeping best practices, and strategies to stay up-to-date with changing tax laws, empowering businesses to maintain compliance and financial integrity.

-

23Time and Resource ManagementText lessonIn "Mastering Time and Resource Management: Strategies for Success," students will learn essential techniques for effectively prioritizing tasks, optimizing schedules, and allocating resources efficiently. This lesson provides practical strategies to enhance productivity and manage both time and resources with greater precision, empowering students to achieve their personal and professional goals.

-

24Assignment: Intermediary Collaboration ExerciseText lessonIn the "Building Bridges: An Intermediary Collaboration Exercise," students will delve into the dynamics of effective teamwork by engaging in hands-on collaborative activities. The lesson is designed to enhance communication skills, bolster problem-solving abilities, and foster a deeper understanding of intermediary roles in facilitating successful group collaborations.

-

25Calculating Realized and Recognized GainsText lessonIn this lesson, students will delve into the intricacies of financial gains, distinguishing between realized and recognized gains. Through engaging examples and practical calculations, learners will gain a comprehensive understanding of how these concepts apply in various financial transactions, enhancing their ability to effectively assess and report financial outcomes.

-

26Understanding Basis and Depreciation RecaptureText lessonIn this comprehensive lesson on "Mastering Basis and Depreciation Recapture," students will delve into the complexities of calculating and adjusting the basis of property assets and explore the nuances of depreciation recapture in various financial scenarios. By the end of the course, learners will be equipped with the practical skills needed to manage these essential tax concepts effectively, ensuring compliance and optimizing financial strategies.

-

27Filling Out Form 8824 CorrectlyText lessonIn this lesson, students will gain a comprehensive understanding of how to accurately complete Form 8824, crucial for reporting like-kind exchanges to the IRS. Through a step-by-step guide, participants will learn to navigate each section of the form, ensuring compliance and maximizing tax benefits while avoiding common pitfalls.

-

28Quiz: Financial Calculations and Compliance21 questions

- Course Title: Unlock TAX-SAVING Opportunities with 1031 Exchange

- Description: Discover the fundamentals of the 1031 exchange to legally minimize tax liabilities and strategically plan your financial future.

- Key Topics: Tax deferral strategies, Eligible property identification, Exchange periods and rules, Types of 1031 exchanges, Tax implications and handling 'boots'.

- Learning Outcomes: By the end of this course, you will understand how to leverage 1031 exchanges, work with qualified intermediaries, and accurately compute relevant financial metrics.

- Duration: 6 weeks with interactive modules, quizzes, and case studies.

- Basic understanding of real estate and tax principles.

- Access to a calculator for financial computations.

- Willingness to engage in practical exercises and case studies.

- Interest in strategic financial planning and tax-saving mechanisms.

- Commitment to complete weekly assignments and assessments.

- Real estate investors looking to optimize their tax strategies.

- Financial planners and advisors keen on expanding their service offerings.

- Property managers and real estate professionals interested in advanced tax deferral techniques.

- Accountants who wish to deepen their understanding of 1031 exchanges.

- Individuals planning to engage in real estate transactions to maximize wealth growth.